Why would a smart engineer/doctor/etc. hire a financial planner?

- John Krehbiel

- Dec 26, 2022

- 4 min read

You’re smart and good at solving problems. Why would you hire someone to help you with something as important as your finances when you already have the analytical skills and discipline to figure out how to get the most out of your money?

There are 3 primary reasons that a smart person or couple decides to hire a personal financial planner.

Your time is better invested elsewhere: The same reason you hire someone to mow your lawn.

Tools and Expertise: The same reason you hire someone to repair or tune-up your car.

You know it’s important, and you don’t want to worry about whether you are getting it “right”: The same reason you hire a lawyer to write your Will.

Reason #1: Your time is better invested elsewhere: I believe anyone can learn enough to manage their money reasonably well. But it does take time and continual study. Often the essence of problem solving is optimizing among multiple trade-offs, and your time is a key area for optimization.

Family Time: A time trade-off that busy couples struggle with

Is your time better spent:

over a long dinner with your family, or logging-in to check on your brokerage account?

coaching your child’s team, or reading the Wall Street Journal and Forbes on-line?

Your money decisions should support your goals and values. This includes the decisions you make every day about how much time to spend on your money. A personal financial planner can off-load the time burden of learning and worrying about money so that you can spend more time on your job and your family.

Time on your Job vs. Time on your Money: Which plan gives you a better life and more success:

(1) You invest your time learning about managing money, or

(2) You invest the same amount of time becoming even more of an expert in your high-paying, expertise-driven job?

Basic economics regarding the division of labor suggests that specialization will yield greater overall output because each contributor can focus on what he or she does best. Just because you can do something, doesn’t mean that doing it is the best use of your time.

Reason #2. Tools and Expertise that Personal Financial Planners provide:

On the one hand, personal finance is simple while you are working:

Spend less than you earn

Save 15% or more for retirement

On the other hand:

401(k) or Roth IRA or Roth 401(k)?

Stocks or bonds or cash?

ETFs or mutual funds?

Fund a 529 College Savings plan or save for a down-payment?

When should I exercise my stock options or start taking Social Security?

Health FSA or HSA?

And the BIG ONE: How do I minimize taxes given my changing circumstances almost every year? (Note: This is an area that investment advisors often ignore, but financial advisors should be on top of).

Engineers and doctors bring both the latest tools and years of expertise to their craft, and so does a good personal financial planner.

Tools: New, user-friendly, graphics-based software makes personalized financial life plans easier to construct, easier to understand, and more widely available. (You can find two more in-depth articles on these tools on my blog at http://krehbielfinancial.com/blog/ Modeling Your Personal Finances - Part 1 and Modeling Your Personal Finances - Part 2). With any complicated tool, like an oscilloscope or an EKG, there is a certain level of expertise required to understand the output of the tool, and to manipulate the inputs to get the information that is needed. The same is true for financial planning tools.

Expertise: Let me illustrate the need for financial planning expertise by sharing my experience as a financial Do-It-Yourself’er for over 30 years.

I’ve done well managing my own money while working in tech and teaching physics. I subscribed to the Wall Street Journal, read Money magazine regularly, did my own taxes, and managed my investments (primarily in 401(k)’s and various accounts at Schwab). With this level of effort, I got a lot of things right, but I also missed a few things that an expert would have caught. For example, I missed some good opportunities to do a Traditional IRA to Roth IRA conversion, and I didn’t optimize them when I could have. Also, I got burned on the taxes on a Deferred Compensation Plan, that I thought worked like a 401(k) but, “surprise”, it didn’t if the company no longer wanted it to. There have been other small ones that I recognize now, given the training and experience I’ve been through. Just like in engineering, we learn by studying, by trying things, by making mistakes, but also by going to an expert if it’s really important.

Reason #3: You don’t want to worry about whether you are getting it “right”: Most engineers, doctors, and other professionals I know don’t enjoy personal finance the way I do. They would much rather spend time on other things (that was the basis of Reason #1). But they have this nagging thought, “this money stuff is pretty important, maybe I should be spending more time on it.” The coursework to become a CERTIFIED FINANCIAL PLANNERTM includes 7 specific courses from investments to taxes, and saving for education to estate planning. Much of that material may not apply to your situation, but you also don’t know what you don’t know. Like with many services, you can spend the time to learn and do it yourself (like I did) or spend money to hire an expert who can get it right.

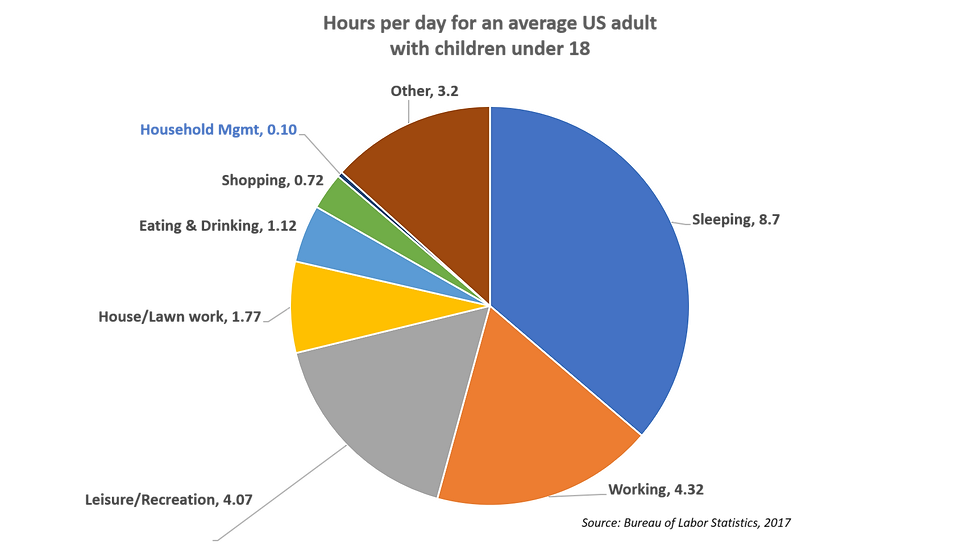

Apparently most busy people don’t spend much time on their finances. According to the Bureau of Labor Statistics’ American Time Use Survey, the average adult with children at home spends only 6 minutes/day on the category of “Household management” (see the chart and https://www.bls.gov/news.release/pdf/atus.pdf). This isn’t much time being allocated to getting your finances right.

Bottom Line: You’re busy! Hiring an expert and developing a personalize financial life plan can be the best way to:

Optimize your time

Get the most out of your money

So you can live your best life!

Comments